The rules for awarding and repaying loans would remain unchanged, but the government would make all loans itself, ending the practice of subsidizing loans made by private lenders.

The Obama administration, which has made revamping the student loan system a major domestic priority, has hailed the bill as historic.

“”This is a big, big deal,”” Education Secretary

That depends on how one interprets budget data, however. The nonpartisan Congressional Budget Office found that the loan program changes should save the government

It also noted in its official July report on the bill, however, that it would include spending all but

“”The truth is, no one really knows how much this plan will cost,”” said Rep.

Independent analysts agreed.

Changes in the loan program will “”save a big chunk of money,”” said

Goldwein warned that the new system’s fiscal outlook would be “”particularly uncertain”” because it would depend on economy-related factors such as default rates, need-based aid and other factors.

The bill would scrap much of the current student loan system, which critics say is too costly and too complicated.

Currently, the federal government provides loans through two different programs. It lends directly to students, and it administers the guaranteed loan program, in which students get funds from private lenders, with most of the loan guaranteed by the government against default.

Under one such loan, the government pays the interest while the student is in school. The student then begins repaying six months after graduation. If he or she defaults, the government makes the payment.

Until 2006, rates were variable but capped at 8.25 percent; after that they were fixed at 6.8 percent, with bipartisan support. Some rates then were lowered, but they’re scheduled to go back up to 6.8 percent in 2012.

The bill would end the guaranteed loan program after next summer; then the government would make all loans directly.

That frightens some members of

“”

He sees parallels to the health care debate. Obama has urged creating a government-run health insurance program, or public option, to compete with the private sector.

“”The legislation (on student aid) we’re about to bring up … eliminates the private option and leaves only the public option,”” Kline said. “”It kind of makes you wonder, doesn’t it, about the designs on the future of the public option in health care.””

The new program would create big savings, the CBO figures. It would save money because of changes in subsidy rates, the CBO said. Some savings could be achieved with lower interest rates; the bill would set a new rate based on the price of 91-day Treasury bills plus 2.5 percentage points. The rate would be adjusted annually.

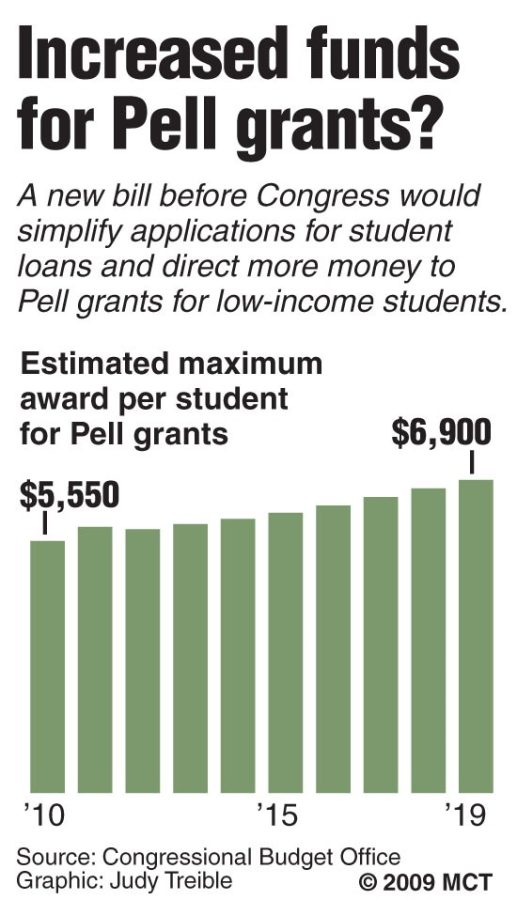

At the same time, though, the measure would expand the cost of the Pell Grant program, which helps lower-income students. Currently, the maximum annual award is

Members of the

“”Any investment we can make in Pell Grants is money well spent. There’s been irrefutable evidence that providing low-income families with these dollars year after year increases access to education,”” he said.

Most activists and lawmakers agree on at least one point: The application process needs to be streamlined. The bill promises to “”dramatically cut down the number of questions on the form,”” partly by allowing students and families to apply for aid using data from their tax returns.

———

ON THE WEB

Congressional Budget Office analysis of student aid bill:

https://www.cbo.gov/ftpdocs/104xx/doc10479/hr3221.pdf

CBO student aid update:

http://republicans.edlabor.house.gov/media/file/PDFs/090909cbolettertokline.pdf

http://www.nasfaa.org/publications/2009/an3221letter072109.html

GI Bill history:

———

(c) 2009, McClatchy-Tribune Information Services.

Visit the