In my senior year of high school, I found myself applying to all my dream colleges. I was extremely hopeful I would get in because I made sure to keep the best GPA and grades possible. I had applied to Columbia University and the University of Chicago and some other smaller colleges and universities. I never gave it much thought; I assumed I had to go to college because that was what everyone expected of me. My family, friends, teachers and even my school counselors expected that I continue my education. I was not the only student; I realized that the teachers and counselors at school were encouraging every student to attend college, even if it was not what the student wanted.

One day at a senior meeting, the school counselors started to talk about financial aid, student loans and grants. I had finally realized that I would not be able to afford half the schools I applied for. Although the teachers and counselors encouraged students to get student loans if they could not afford college, that was not an option I was willing to take; I knew some of these teachers that were encouraging us to get student loans still had not even paid off their own. I did not want the weight of debt on my shoulders, as I had seen reports of the ever-growing student debt balloon in the U.S. I completed the FAFSA, but I quickly realized that my family made too much money and I could not get much help from the government.

RELATED: OPINION: Goodbye spring break

Yes, I applied for scholarships. I did 10 to 20 applications each day for months. Unfortunately, I did not receive as many as I needed due to the competitiveness with other students also applying. I had the grades and the after-school activities, but that was not enough because — again — my family made too much money.

The standard of making “too much” money was what held me back and it was extremely infuriating. My family is middle class, and don’t get me wrong I am thankful that my father has a good job. Something scholarship applications and the FAFSA failed to recognize is that I have two older brothers who were already in college by the time I was entering. My father tried to help pay for my oldest brother’s college experience, but it pretty much ran him dry. My middle brother had to pay for college himself because my father could no longer help.

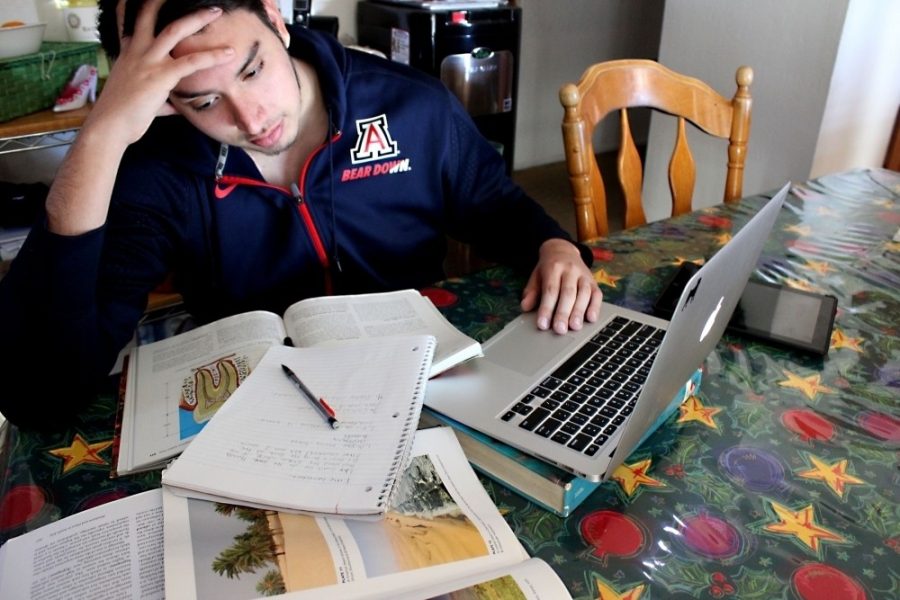

So, what was I left with? My family made “too much” money, yet I had to pay for college all alone and I did not want debt. My cheapest choice of university was then the University of Arizona, thankfully, through their merit scholarships. It did not cover everything but it had become my cheapest and most affordable option.

Although it was the more affordable option, I am currently paying more for tuition and fees than my brothers did — this is due to the increase in tuition cost each year. Every year it seems that the in-state tuition increases by approximately $1,000 and the out-of-state tuition increases by around $3,000.

COVID-19 has made matters worse for me. It’s harder to find a job during this pandemic to help pay for school and rent. All my classes also ended up being online, which means that on top of the fact that I am still paying the ridiculous amount of fees and tuition out of pocket, the university no longer feels worth it.

Although my family makes a middle-class income, I am also aware that other students who are lower-class have just as much trouble or even more trouble getting into the universities and colleges that they want. Although they most likely qualify for financial aid, it never is enough to cover the full tuition, fees and cost of living.

Due to high schools making it seem like college is the only way to ever get a job, more students find themselves in debt to get a degree that may not even be related to the career they will have in the future. As more students go to college, they drive their prices up because they know that students are expected to go to college — your basic supply/demand linear relationship. Students will continue to attend and as prices soar, more will apply no matter the cost.

Follow Andrea Moreno on Twitter

Andrea is a freshman law major. She likes to listen to audio books and game in her free time.