UA students, along with many others in the U.S., are still suffering from debt resulting from student loans, particularly as the numbers rise.

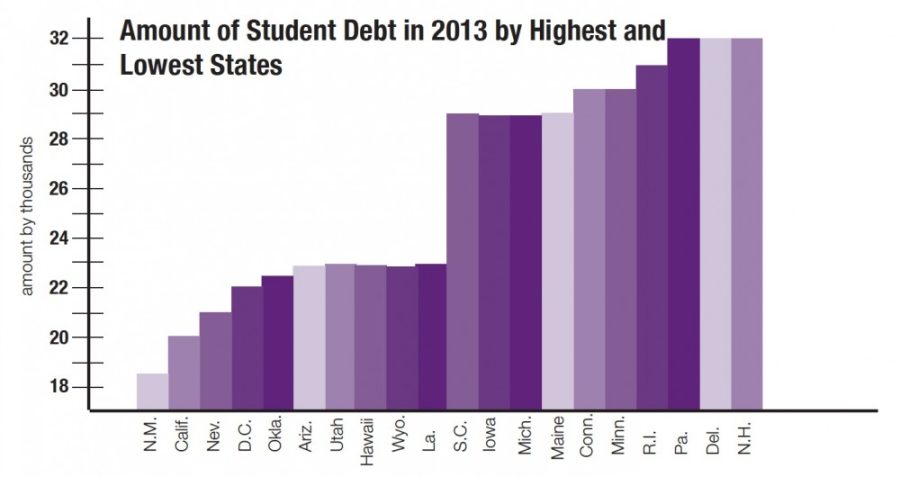

Data from the Project on Student Debt shows that in 2012, seven out of 10 graduating seniors faced student loan debt. The average college graduate who borrowed money accumulated $29,400 of debt by the time of graduation. The highest debt regions, according to the data, are the Midwest and the Northeast. Arizona is categorized as a low-debt state, with an average of $20,299 debt by the time of graduation.

In a recent report from the Federal Reserve, a rise was seen in the outstanding debt of student loans taken out, with the numbers ranging from $831.6 billion in 2009 to $1,311.5 billion at the end of 2014. The average total educational debt for College of Medicine — Tucson students for 2012-2013 was $135,419, according to the College of Medicine Office of Financial Aid. In the same year, about 18.2 percent of medicine students graduated with a debt of over $200,000.

Many students make the decision to apply for student loans because it is the only way they are able to afford a college education.

According to the Federal Student Aid, an office of the U.S. Department of Education, two types of federal loans are offered, the William D. Ford Federal Direct Loan Program and the Federal Perkins Loan Program. A student is not required to begin repaying their federal student loan until they graduate or reduce their schooling to below half time.

There are seven repayment plans for direct loans and federal family education loans: standard, graduated, extended, income-based, pay as you earn, income-contingent and income-sensitive.

A Project Student Debt press release from Sept. 24, 2014 said new federal data shows that over 650,000 student loan borrowers from 2011 defaulted on their loans by 2013.

Laura Hacker, a pre-physiology sophomore, said she hopes to avoiding taking out any student loans if possible.

“I plan on furthering my education and if I have the means to pay now, I would rather pay off my undergrad now than be paying for medical or graduate school in addition to paying off loans,” Hacker said.

Federal Student Aid advises that students be aware of the legal obligation attached to the loan and the interest rates before applying.

According to Federal Student Aid, the current interest rate for undergraduate direct subsidized and direct unsubsidized loans disbursed on or before July 1, 2013 and before July 1, 2014 is 3.86 percent; the current rate for undergraduate direct subsidized and direct unsubsidized loans disbursed on or after July 1, 2014 and before July 1, 2015 is 4.66 percent.

Connor Cirillo, a pre-business sophomore, said some students with student loans don’t understand the consequences of using their loans for nonacademic purchases, such as using their bursar’s account to purchase unneeded items at the UA Bookstore.

“People don’t see it as an issue,” Cirillo said. “There’s nothing coming out of their pocket, so they don’t understand.”

He explained his own decision to apply for a student loan as an investment in himself.

“School is helping set me up to be successful in my career,” Cirillo said. “I’m learning skills based on opportunities I wouldn’t have otherwise.”

_______________

Follow Brandi Walker on Twitter.