With the nation’s economy struggling, paying for college has also become a struggle for students and parents alike.

The Office of Student Financial Aid has seen an increase of about 17 percent in financial aid applications this year compared to last year, according to Katharine Baggett, a senior program coordinator in the office.

The Free Application for Federal Student Aid itself takes into account the state of the economy this year with a new question about dislocated workers within a family.

Because of the economy and state budget cuts, tuition has been steadily increasing. In fall 2007, tuition for a regular in-state undergraduate student at the UA was $2,523.92, according to the Bursar’s Office Web site. In fall 2008, that amount increased to $2,772.06. This semester, tuition is $3,427.56.

“”Our primary objective is that we are here to help students complete an education,”” Baggett said. “”You really can’t put a price tag on how much your education is really going to be worth.””

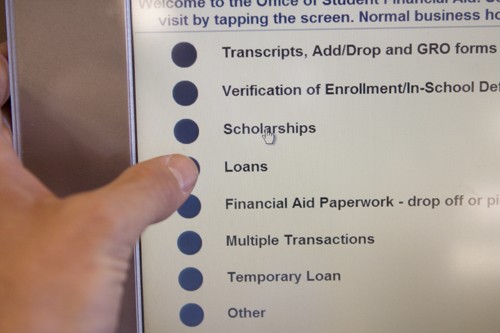

During this time of year, the Office of Student Financial Aid receives about 75 to 100 e-mails, 100 phone calls and 70 to 80 personal visits to the office on average per day, said Baggett.

“”And this is what we call our slow time,”” she said.

The office has six professional staff members, 27 classified staff members, and 39 student workers to address the financial concerns of parents and students.

The biggest change Baggett notices from last year is the number of students in the Federal Work-Study Program. The fact that more students are trying to find jobs makes the job market more competitive.

In the Federal Work-Study program, the federal government allocates money to the UA to help pay student workers. The government pays about 35 percent of the salary while UA pays about 65 percent, according to Bryan Scott, assistant director of the Office of Student Financial Aid.

Students have to demonstrate financial need through their FASFA to apply for the Work-Study program.

Although the Office of Student Financial Aid will not be able to track how many more students are using the program this year until the end of next semester, Scott said they have seen an increase.

In the past, about one to two students would apply for an open position in the Work-Study program. Now when there is an open position, nine to 10 students apply, according to Scott.

In addition, there are about 320 students on the Work-Study waitlist, compared to about 200 last year.

“”It’s really popular,”” Scott said. “”A year ago it was not quite this high.””

Rachel Harrison-Lewis, a pre-physiology junior, transferred to the UA this semester and is paying for college on her own. She said her plan was to pay off her loans before she accrued too much interest, but so far she has been unable to find a job.

“”I’ve definitely had to become a better shopper,”” she said.

Harrison-Lewis said she only pays for the necessities, and has made some sacrifices, including not joining a sorority.

“”I have to look at it in the long run,”” she said.

All students should fill out a FASFA application, regardless of their current financial situation, Scott said.

“”Most of us can’t predict what the future’s going to be,”” Scott said.

Scott and Baggett also said students should create a budget and stick to it. Usually, the Office of Student Financial Aid distributes scholarship and financial aid money once per semester, so students should spend it wisely, they said. Ultimately, the reason students are here is to get an education, Baggett said, and sometimes they must sacrifice attending sporting events or other extras to save that money for basic expenses.

Ray Parkman, a psychology senior, said he is relying on financial aid to help him pay for college. He said he got laid off from his job with the City of Tucson in August. Parkman said he does not go out as much as he did before.

“”I’m not as extravagant as I used to be,”” he said. “”I pay for what I need, not what I want.””

About 90 percent of students who use financial aid are employing a variety of methods to pay for their education, including scholarships, grants and loans, according to Baggett.

Students often have a mental block against using loans, Scott said. It’s better for a student to take out a loan to pay tuition than to spend an extra semester in college because they are working so hard to pay for it, Scott said.

Baggett said during the process of verifying tax information or changes in income, more parents are sending in multiple W2 forms, which means they are working more than one job.

“”Parents are trying to do just about any kind of job to keep the family going,”” she said.