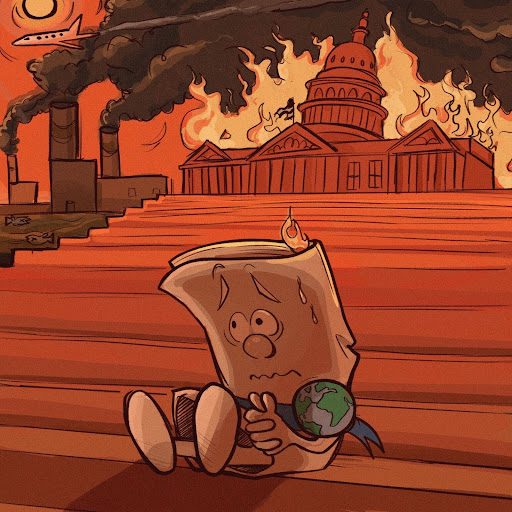

Student-led organization UAZ Divest is on a mission to discontinue the University of Arizona’s investments in fossil fuels, which as of 2019 amount to over $64 million.

The group emphasizes that the university’s investments in fossil fuels are negatively contributing to the ever-intensifying climate crisis and they demand that the university abandon its current investments in fossil fuels by 2025, as well as pledge to refrain entirely from investing in fossil fuel corporations in the future.

The Daily Wildcat spoke with the UAZ Divest executive board, including president senior Frances Slater, direct action committee chair junior Stella Heflin, and secretary sophomore Sam Wetherell to discuss the organization’s goals and plans for the future.

“I think our current goal for the semester is to increase student awareness of the fact that the university has invested in fossil fuels and raise general support because … this is an issue that people should care about, and that needs to change,” Heflin said.

In addition to student awareness, UAZ Divest wants the University of Arizona Foundation, the governing body in charge of the UA’s philanthropic assets, to strengthen their sustainable and socially conscious investment strategies and partnerships and include student voices within the board of trustees.

Heflin stated that UAZ Divest was inspired by regents’ professor in the School of Geography Diana Liverman, a lifelong climate activist, who suggested divestment as a viable strategy for combating the university’s negative climate impacts. The organization stressed the significance of divestment and how it can cause a tremendous impact on the industry being divested from.

“Divestment works. We’ve seen it happen with tobacco companies; colleges divested from them and their advertising went down, and the use of cigarettes went down dramatically,” Slater said. “Once enough people do it, it’s so impactful, and universities have always been on the front end of divestment.”

UAZ Divest was established in March 2020 during the onset of the pandemic, and was propelled by the idea that the planet’s climate crisis is accelerating at an unprecedented rate, which fossil fuel corporations are ignoring and continuing to expedite via their mass production of unsustainable resources.

“We’re seeing extreme weather patterns, we’re seeing droughts, we’re seeing water allocations to Arizona cut, we’re seeing extreme hurricanes on the East Coast, we’re seeing wildfires in California and extreme temperatures in Oregon,” Heflin said. “We’re seeing and really experiencing, especially this summer, the impacts of climate change, and fossil fuels are directly responsible for this.”

The organization sent a letter to the UA Foundation board of trustees on Jan. 13, 2021, highlighting their demands to discontinue the UA’s fossil fuel financial ties and how more eco-friendly investment choices can serve to mitigate the repercussions of the climate crisis. The board responded on Feb. 15, 2021, stating that their Investment Policy Statement is undergoing an annual review and that Environmental, Social and Governance would be “top of mind for our Investment Committee.”

As of 2019, UAZ Divest discovered that the UA has invested in fossil fuel investment firms like Scout Energy Partners, Pelican Energy Partners, EDGE Natural Resources and Rockland Power III, with investments adding up to $32 million, $14 million, $11.5 million and $6.5 million, respectively, according to the organization.

These expensive contributions to companies managing oilfields, unsustainable resources and non-renewable energy systems directly contradict the UA’s claims of being green and sustainable.

In 2019, the university signed an extensive renewable energy contract with Tucson Electric Power, hoping to offset its scope two emissions to net-zero and reduce the greenhouse gases released into the atmosphere. However, with the UA’s costly fossil fuel investments, it seems as though the goal for total sustainability was not fully realized.

“It’s kind of a contradictory message. I mean, as a student who came here because I was interested in their sustainability, it was kind of heartbreaking to learn we’re going directly against that with our huge investments in fossil fuels,” Wetherell said. “And also, they are contributing to the climate crisis by quite literally funding it.”

Heflin added that many of the fossil fuel companies whom the UA has invested in are aware of the environmental impact of their industry but simply neglect it, choosing instead to maintain the status quo rather than help to restore the planet’s ecological well-being.

Additionally, Heflin expressed concern over studies reflecting that Tucson could be relatively uninhabitable by the end of the century as a result of the climate crisis.

“As current students who as alumni might want to come back to this campus, who definitely have a vested interest in seeing the school still standing and still flourishing in the coming decades and centuries, it’s kind of heartbreaking knowing our city might disappear, or become less populated or uninhabitable due to actions that the university is complicit in,” Heflin stated.

The question is, how can the university claim to advocate for sustainability while they actively funnel financial support to the companies responsible for the burgeoning ruin of our planet?

One might argue that divestment from fossil fuels would be financially irresponsible, but Slater assured that divesting from fossil fuels does not impact the school’s fiduciary duty, meaning that it would not put the university’s investment funds at risk.

“Essentially, it’s a smart financial decision,” Slater said. “Oil and gas are super unstable pricing wise, and it’s a super smart decision for the school’s image and the students’ respect of our university’s investments.”

Slater also added that UAZ Divest has worked alongside a group called Divest Ed in pursuit of their divestment goals, which have allowed the topic of divestment to become more apparent as a national issue. They have found that numerous universities from across the country engage in the practice, including the University of California, which has completely divested from fossil fuels after previously investing over $1 billion.

UAZ Divest is confident that the UA can reasonably divest entirely from fossil fuels, but they want more students to be involved in their quest for climate justice. The group recently held a rally on Friday, Aug. 27 at the UA Mall in order to gain student support for their cause of divestment and are also hosting an open meeting on Monday, Sept. 13, at 6 p.m. in the Main Library, room A119, which any interested students are welcome to attend.

Slater also advised that students interested in helping UAZ Divest can do so via letter writing to the UA Foundation and by participating in direct action events, which the organization is currently planning to hold throughout the semester.

The group has high hopes for the advancement of their goals this semester and intends to continue their crusade to curb the climate crisis well into the future.

Follow Vic Verbalaitis on Twitter