The Credit Card Accountability, Responsibility and Disclosure Act, which went into effect on Monday, aims to reduce credit debt for people under 21.

The CARD Act introduces various new requirements for credit card companies to follow, such as giving cardholders a 45-day notice before increasing interest rates or changing their annual or late fees. It also gives them the opportunity to cancel their account before those changes occur.

Especially relevant to college students are the new rules which state that credit card companies cannot give people under 21 credit unless they can prove they have the ability to pay. If they don’t bring in a regular paycheck, they must find someone to co-sign for them.

These provisions were not part of the original legislation, but were later added by Congress to the CARD Act, according to Jeanne M. Hogarth, who works on the Federal Reserve Board’s Division of Consumer and Community Affairs.

“”I think Congress was hearing horror stories about the level of credit card debt that students were facing and really, really trying to address this by saying, ‘We have a set of people who are not yet quite ready for full blown credit on their own, let’s find a way to give them credit experience to lead to a positive outcome for them,'”” Hogarth said.

Hogarth, who oversees all of the board’s federal education outreach efforts, spoke at the UA on Thursday about how the CARD Act protects consumers in this financial market.

Hogarth emphasized that consumers can now do a lot of things with their credit cards, besides charging purchases. They can transfer balances from one card to another, part of an effort to bring regulations up to speed with the changing technologies.

“”As things change in the marketplace policies and regulations … our educational and outreach efforts have to change along with them. We were seeing rise in risk-based pricing,”” said Hogarth, reflecting that credit card companies give out lines of credit to those with bad credit and simply charge a higher price, in the form of more fees or higher interest rates.

Hogarth said several people have asked her if these changes are a result of the current financial crisis, but the Federal Reserve Board has been working on this project since 2006. It wasn’t until May 2009 that Congress turned the projected policies into law. The act’s provisions will go into effect throughout this year.

These policies are meant to hold lenders and consumers accountable. One specification of the act requires that those who have no stable income have a co-signer serves as a safety net.

“”That co-signer might serve as a mentor or a coach to you and help you not make the mistakes maybe they made when they were 18 or 19,”” Hogarth said. “”The bad news is you have this co-signer on your credit card, and you’re maybe not going to be able to do everything you want to do.””

If someone doesn’t have a steady paycheck or someone to co-sign, they can sign up for a secured credit card. This means putting down a security deposit, which then becomes their credit limit. The problem with this is finding the money for your security deposit, Hogarth said.

In addition, credit card companies will no longer be allowed to solicit anywhere on or within 2,000 feet of campuses. Companies are not permitted to advertise their cards at university events or give away “”tangible items,”” such as T-shirts, coffee mugs, key-chains or baseball caps. They may still offer students lower introductory interest rates.

Hogarth said the idea is for people to shop around and compare credit card offers. She added that it is important for people to understand interest rates and fee structures and to pay their credit card bill on time.

Hogarth recommends making more than the minimum payment, being aware of fees, “”avoiding avoidable fees”” and paying attention to changes in the terms of their card.

According to 2009 research by Sallie Mae, 84 percent of undergraduates had at least one credit card, up from 76 percent in 2004. Students have 4.6 credit cards on average, with half of college students holding four or more cards.

Kate Herron, a veterinary science sophomore at the UA, has a credit card which she got about a year ago at a promotional event on Arizona State University’s campus. She said they were giving away free T-shirts and frisbees, so she got a credit card and a Frisbee.

“”I don’t think (the CARD Act) will help them (college students) save money, but I think it will be more difficult for them to spend it,”” said Herron.

She said she doesn’t charge her tuition to her credit card because her limit isn’t high enough, but 30 percent of students do, and 92 percent charge expenses related to education, such as textbooks, Sallie Mae reported.

Herron doesn’t anticipate being in credit card debt when she graduates.

“”Well, I pay it off every chance that I get, so I probably won’t be in debt because I make sure that I don’t overspend,”” she said.

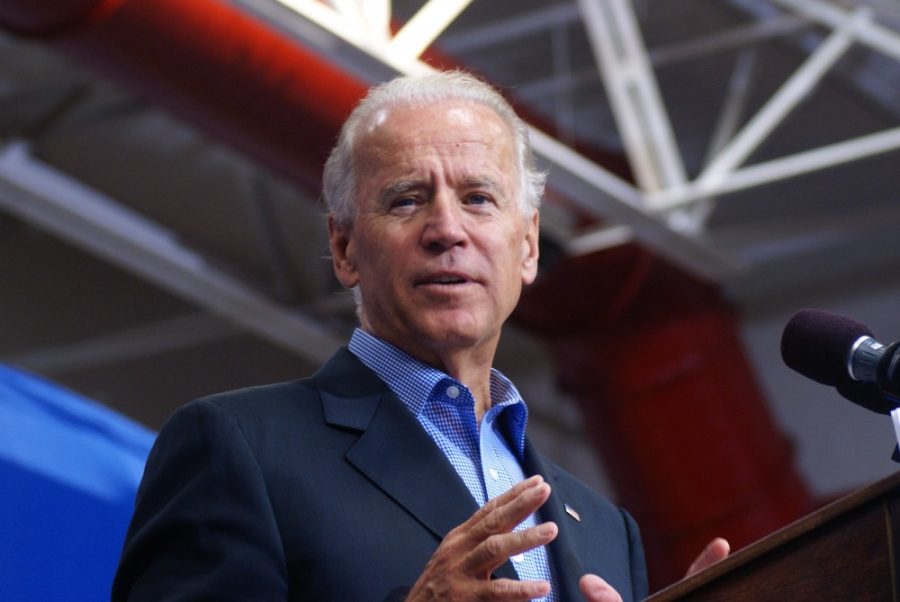

Jared Bernstein, senior economic advisor to Vice President Joe Biden, said the CARD Act is, “”helping to protect consumers from practices that in the past have gotten us into this hole we’re in.””

Bernstein said credit card companies have been allowed to get away with shady practices that are difficult for people to sort out and have dramatically impacted younger Americans.

“”If you look at the statistical evidence of credit being used in a way that is not particularly safe, in some cases reckless, … there’s kind of a spike in the early years that begins drifting down in the early twenties, so 21 seemed like a reasonable place to put the age cut off as to what age this problem is most prevalent,”” Bernstein said.

Debt is particularly unfortunate for young consumers, Bernstein said. It’s tougher to get a career started on a good foot with pressing debts, and debt negatively affects credit scores.

“”We’ve encouraged colleges to make sure that the students themselves are oriented to receive an orientation to learn about what they’re getting into,”” Bernstein said. “”The idea here is to help make sure responsible practices dominate … because the consequences are great.””