At the same time, however, banks overall reported strong income during the quarter, providing some grounds for optimism.

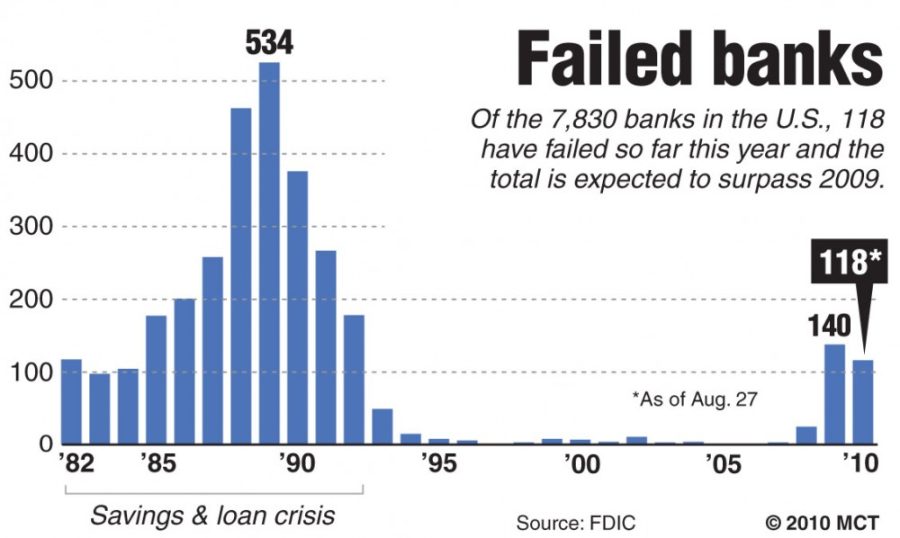

There have already been 118 bank closures this year through last Friday. The big number of problem banks — rising from 775 in the first quarter — suggests that more than 22 additional banks could fail before year’s end, exceeding last year’s tally.

The number of problem banks is the highest it’s been since

But

“”This is the best quarterly profit for the banking sector in almost three years,”” Bair said. “”These results provide more evidence that the sector is moving along the road to recovery. … The levels of noncurrent loans and charge-offs are beginning to trend downwards.””

Banks and thrifts regulated by the

In another sign of modest improvement, only 20 percent of

Although provisions for potential loan losses remain high at

The number of loans that were 90 days or more past due fell from April to June, the first time that’s happened since the first three months of 2006.

The total of number of loans and leases declined 1.4 percent in the quarter, however, as did the total assets in banks, which fell 1 percent to

“”Particularly given economic uncertainties, we believe all banks should continue to exercise caution and maintain strong reserves,”” Bair said.