President Barack Obama spent the last week addressing U.S. higher education issues, including student loan debt.

Obama signed a Presidential Memorandum to help student loan borrowers repay their debt. The executive action retroactively extends the 2010 legislation that capped loan payments on federal direct loans at 10 percent of the borrower’s income to nearly 5 million additional people.

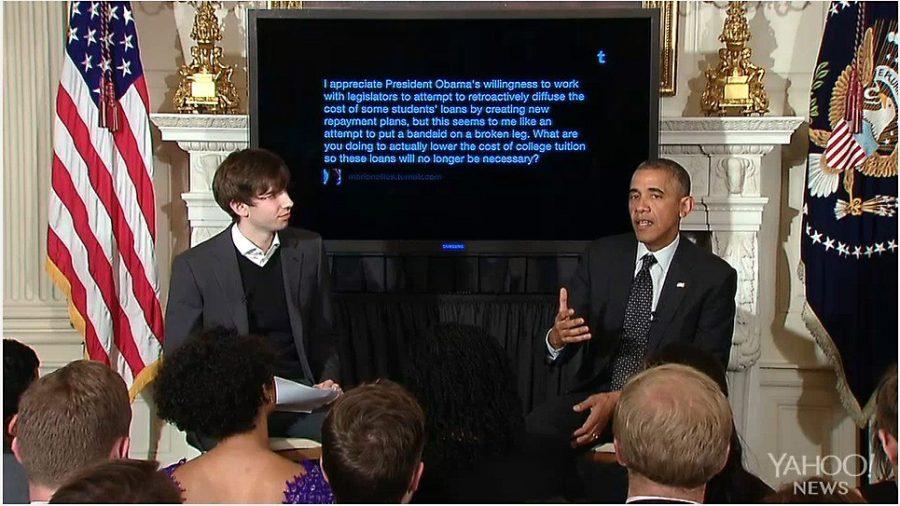

Obama used the website Tumblr to answer questions from American students regarding the difficulties facing college graduates. Many of the questions, submitted by bloggers on Tumblr and selected by the website’s founder David Karp, dealt with high tuition and student loan debt.

Though the cost of an education is high and the effect of debt can be staggering, Obama encouraged young Americans to continue seeking degrees.

“It continues to be a very good investment for you to go to college,” Obama said.

Other legislative action aimed at helping college graduates manage debt has not fared as well. S. 2292 was a bill introduced by Sen. Elizabeth Warren of Mass. The bill would have raised taxes on high income families and businesses in an attempt to keep student loan interest rates at 3.86 percent, but was filibustered in the Senate on June 11.

In a statement, the Arizona Students’ Association spoke out against the filibuster to the bill. The statement pointed out that the current U.S. economy relies heavily on middle-aged Americans making larger purchases, but many college graduates will be too burdened by debt to qualify for mortgages or start families in the near future. The ASA suggested this trend could cause an economic collapse in 20 years.

A study performed by the UA between 2007 and 2013 showed that half of college graduates rely on financial help from parents or relatives two years after graduating. The study also found that graduates were delaying significant life goals. 19 percent of respondents to the study said that owning a home was not important to them, and around 28 percent said the same about marriage.

“We also have to do a better job of informing students about how to keep their debt down because, frankly, universities don’t always counsel young people when they first come in,” Obama said in his Q&A with the Tumblr community.

Rebekah Salcedo, senior associate director of the Office of Scholarships and Financial Aid, said all UA students who accept loans are required to complete loan entrance and loan exit counseling. She said the online counseling sessions inform students on the implications of borrowing loans.

“Our office works very hard to provide informational resources to students so that they can make the most educated and informed decision possible,” Salcedo said.

Graduates from the UA have a lower repayment default rate than the national average Salcedo said. She said that data collected between 2010 and 2013 showed that UA students had a default rate of 6.8 percent while the national average is 14.7 percent.