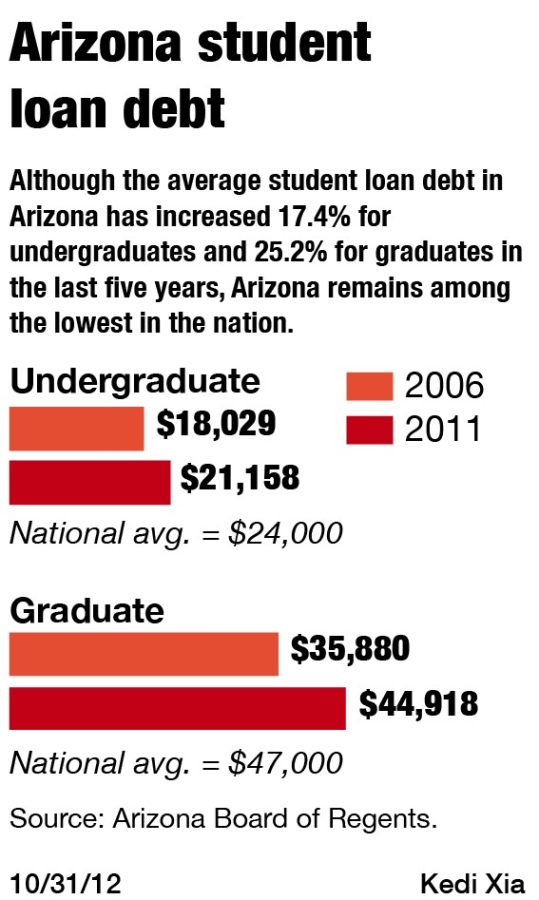

Although student loan debt has become a hot-button issue across the country, especially amid the presidential campaigns, half of Arizona college graduates are below the nation’s average in terms of how much debt they retain when they graduate.

Arizona 2011 graduates fall in the forty-fifth percentile, at $19,950 compared to the nation’s average of $26,600 in debt, according to a financial aid report released by the Arizona Board of Regents.

Sarah Harper, director of public affairs for the board, said that although rising tuition costs have been a problem in Arizona, at the same time, financial aid has increased as well.

“Despite the fact that there has been increases in tuition at our public universities, we still remain competitive among our peer institutions, so we’re still a really big value,” Harper said.

According to Harper, Arizona ranks near the bottom in state-funded aid, but the regents require universities to set aside 14 percent of tuition revenues to return to students for need-based aid. In recent years, the regents have asked universities to set aside 17 percent to combat rising tuition costs.

In the 2010-2011 school year, Arizona universities provided $391 million in institutional aid and provided grants to 69,069 students, Harper said. Over the last five years, the amount of institutional aid has increased by approximately 74 percent, she added.

John Nametz, the executive director of scholarships and financial aid, added that the UA offers students the opportunity to work on campus to earn money and help combat their debt.

Additionally, individual opportunity counseling is offered daily for UA students to help lower debt. Nametz explained that more than 4,000 individual changes are implemented to student financial aid cases due to individual circumstances each year.

Nametz mentioned that students seeking financial aid should look to the AZ Assurance Program offered at the UA. The Assurance Program’s vision is to empower low-income students to become scholars and contribute to society to improve the educational demographics in the state of Arizona.

Michael Staten is a professor of family and consumer sciences and the director of the UA’s Take Charge America Institute, which provides education programs to increase financial literacy. Staten said that taking on some amount of debt is often necessary, and can be viewed as an investment.

“We like to think of student loan debt as good debt,” Staten said. “Taking on debt to acquire those skills that allow you to get into that career earnings path is probably a good investment. But for many kids that [loans] was the ticket to get those skills.”

Nametz added that, along with the lower debt students incur from the lower cost of Arizona compared to other schools, the UA is one of the best higher educational opportunities in the country, and that the university returns the investments its students make in their education.

“This school invests in students in so many ways,” Nametz said. “So much educational opportunity and advantage falls on students due to the position of this university as a Research I and because of the unique convergence of our diversity of opportunity, student makeup, location, geography and climate.”