Even though the University of Arizona community is working on developing a plan for the upcoming semester, last spring proved that students must be prepared for anything, especially in regard to finances.

Professionals in the field of financial wellness have shared a series of insights into how students can overcome and avoid financial hardships during times of uncertainty.

Many of the following tips can be useful to students regardless of the circumstance, but are especially applicable during times of the pandemic.

RELATED:https://www.wildcat.arizona.edu//article/2020/07/n-reentry-briefing-july23

Find a system that works

Taking care of finances is a dynamic process with a dynamic set of approaches. David Hamra, a professor for the UA’s personal and family financial planning program and financial planner at Gordian Advisors, said that there is more than one right path to financial success during the pandemic. Everybody is different and may require a different approach.

“Some people are more inclined to react better to something that’s very structured such as a budget,” Hamra said. “Others can get the same result in a different way.”

Hamra explained that if students don’t use a system that works for them, they are less likely to stick to it and won’t achieve their desired results. For example, when shopping, some will set a strict guideline for how much they can spend and that works well for them.

Others may feel stressed out by this so a more conceptual approach such as focusing on wants versus needs could work better. Trial and error is a simple way to experiment with various techniques and decide which is the most effective.

Starting a new approach for reaching financial wellness can be intimidating, especially when the future seems so unclear. A useful place to start is understanding where one’s money goes. Many people are not even aware of the magnitude of their spending.

For example, some may spend money on fast food every day and not realize how that amount adds up over time.

Using an online resource to understand where money is spent each month can allow for a more hands-off, simple approach to tracking income and expenses.

For example, Mint, a free budgeting app that connects to the user’s bank account, categorizes expenses automatically and encourages users to reduce unnecessary spending each month.

“People are surprised by what they spend on and it makes it easier for them to make changes.” Hamra said.

Look for ways to save

Living within or below one’s means is a major key to financial success.

However, according to Hamra, college culture is moving away from a “starving student” lifestyle into more lavish, high-end living.

Students may feel pressure to adopt costly habits such as living in expensive apartments, eating out and buying name brand clothes, creating financial barriers for many.

Hamra said that students should try limiting exposure to financially destructive temptations. This could mean shopping online less, unsubscribing from enticing email advertisements or meal prepping to avoid eating at expensive restaurants.

“It’s the idea of making decisions for yourself now while you can rather than when you’re forced to,” Hamra said.

Many students aren’t spending as much right now due to the closure of bars, sporting events and local establishments. So, it may be easier for students to save for the future and start practicing healthy spending habits during this time.

Additionally, COVID-19 has created a unique opportunity for students to support struggling businesses while saving money at the same time.

Many businesses are offering sales or discounted gift cards to stay in business; when students take advantage of these deals, they’re helping stimulate the economy and potentially saving businesses from bankruptcy.

On University Boulevard, local business Scented Leaf has been offering buy one get one 50% off loose leaf teas and 20% off tea accessories throughout the summer.

Hamra said, “as a student, this is a time when you can certainly experience living frugally and it doesn’t diminish the experience or enjoyment of college.”

Apply for student emergency funding

In an attempt to compensate students for financial hardships caused by COVID-19, the Office of Scholarships and Financial Aid has been working to provide grants and funding to those in need. Christe LePeau, the financial literacy program coordinator for the Office of Scholarships and Financial Aid, shed light on unique opportunities for students during the pandemic.

The Student Emergency Fund, available through the Dean of Student’s Office, is available to assist with living expenses, food, travel costs, books and other unexpected financial changes caused by COVID-19.

To be eligible for the SEF, applicants must have been enrolled as a degree-seeking student in Spring 2020 and show a need for financial assistance, according to LePeau.

The CARES Act, a federal student relief program, provides funding for students who incurred additional expenses in one or more of the following areas as a result of COVID-19: food, housing, course materials, technology, health care and childcare. Students can apply through the same application as the SEF.

To be eligible for CARES Act funding, students must have a FAFSA from either the previous or upcoming school year and must have been enrolled as of March 13. Fully online UA students are not eligible for aid from the CARES Act or the SEF.

LaPeau also said that, “if you or your family has endured a financial hardship during this pandemic it’s important to know that there are opportunities to work with our office through submission of a General Aid Appeal or a Family Contribution Appeal.”

Angela Perez, a client services representative for the Office of Scholarships and Financial Aid and senior at UA, said students should fill out their FAFSA to gain access to grants and different loan options.

She also recommended students look for campus resources for any difficulties they may have due to the pandemic.

“We’re all going through this, it’s definitely a very challenging time,” Perez said. “The university is working together to help students as best as we can.”

Understand debt

Students often sign up for a new credit card or loan without fully understanding the terms associated with the debt.

Hamra said it’s crucial to thoroughly investigate any debt before accepting it and look for alternate options before taking the maximum loan amount.

“Just because someone will loan you money doesn’t mean it’s smart to take it, keep your debt as low as you can,” Hamra said.

The less debt someone has, the less interest they’ll pay and the quicker they’ll be able to pay off their loan. Before taking the maximum student loan, students should look for other ways to pay for college.

This may mean living in a cheaper apartment, working a part time job or applying for scholarships to avoid taking on too much debt.

In addition to knowing when it’s appropriate to take on debt, LePeau explained that students often struggle to understand their financial aid in regard to the amounts, the terms, time frames and more.

“Whether it is the difference between a subsidized or unsubsidized loan, the renewal requirements for the scholarship they have been awarded, or how to maintain satisfactory academic progress to maintain their financial aid, I find the students often feel overwhelmed.” LePeau said.

LePeau compares most student’s financial aid to a puzzle, explaining that there’s not just one source of funding for all college expenses. Students may use a combination of grants, scholarships, loans and savings to cover costs.

During COVID-19, it’s especially important that students educate themselves on how their financial aid can benefit them and how it may be affected by the pandemic.

Students may qualify for loans with more favorable terms and save money in the long run if they research their options and take time to understand their debt.

Utilize student resources

On and off campus there is an abundance of resources for students with diverse needs and backgrounds.

Alexei Marquez, the financial wellness manager of persistence and completion at the Thrive Center, highlighted opportunities for students to seek overall support and financial help during COVID-19.

The Thrive Center at the UA is determined to help students from diverse cultural groups, underrepresented communities and first-generation college students successfully navigate their education and beyond.

They offer one-on-one financial counseling, graduation plan assistance and other forms of support.

Peer to peer conversations relating to student’s finances often consist of education around budgeting, savings habits and creative problem solving, according to Marquez.

During this summer, the Thrive Center has remained a valuable resource through the pandemic, continuing its programs online and offering virtual one on one meetings. Thrive Center’s work during these difficult times has gone deeper than just helping to ensure financial wellness.

“It’s important to seek counseling and educational resources to ensure that your holistic wellness is taken care of, not just financial wellness,” Marquez said.

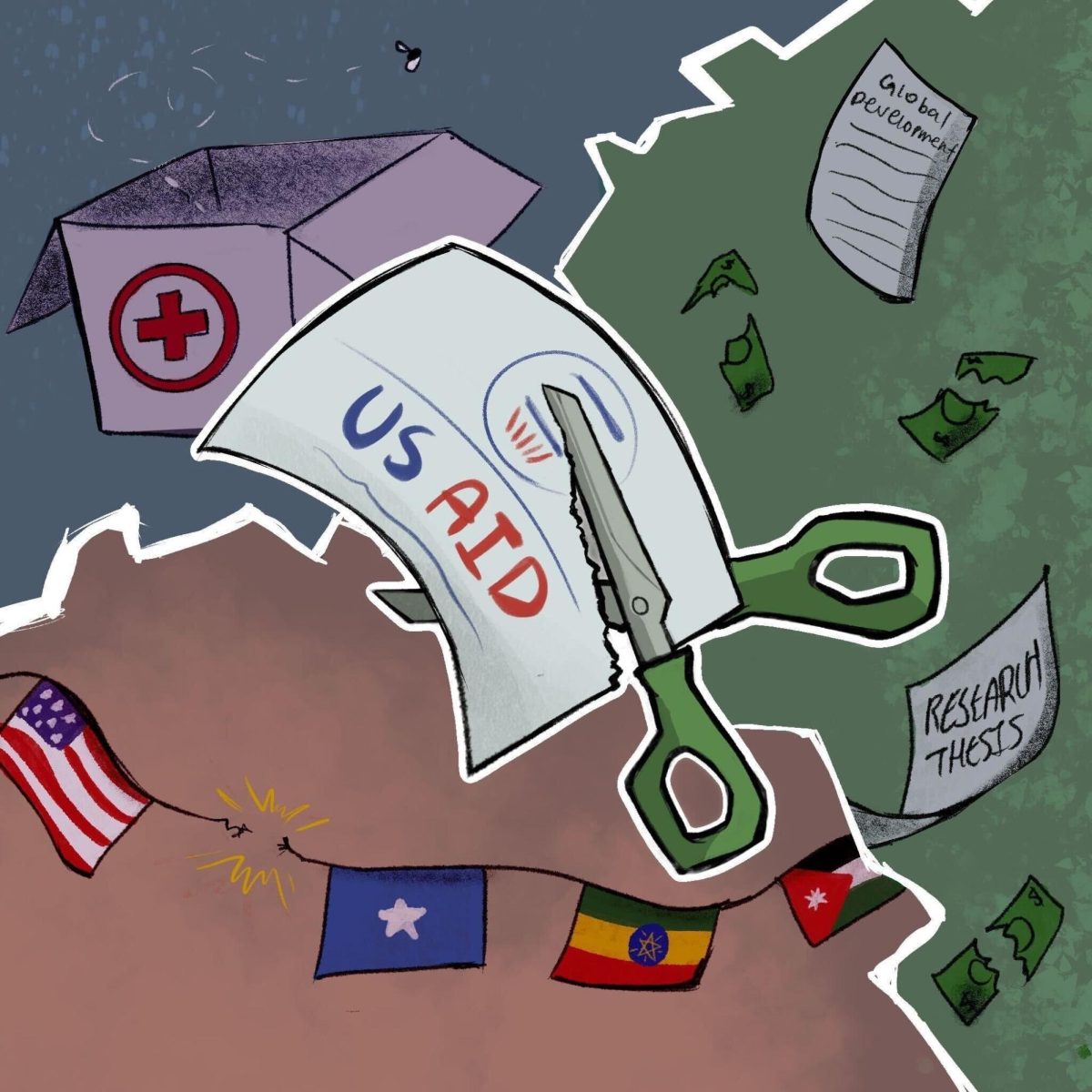

The Associated Students of the UA’s basic needs page offers links to a variety of on- and off-campus resources for students, including COVID-19 aid, housing assistance, food services and mental health support.

Students can also utilize their peer network and share helpful information with one another. Marquez suggests networking with individuals in the UA community to see if there are additional funding opportunities available outside of the CARES act.

A few other ways students can work together to reduce costs include carpooling, rooming together to reduce rent and meal prepping together.

In addition to finding ways to save, LePeau recommended pursuing a part time job as “studies show students who work 10-20 hours a week do better academically.”

Utilizing the Federal Work Study program can be a helpful resource for students with financial need seeking part time employment.

Another helpful resource is UA’s Scholarship Universe, which provides tailored scholarships for students depending on their major, qualifications and interests.

LePeau is currently working on creating a video series that will provide tips and insight on how students can use this resource to their advantage.

“I hope that these videos will encourage more students to utilize Scholarship Universe in a new way and hopefully even be granted some new scholarships,” LePeau said.

RELATED:https://www.wildcat.arizona.edu//article/2020/07/n-new-law-journal

Plan for the unexpected

A common theme during the last few months has been unpredictability in everyday life.

Not knowing if a job is secured, not knowing if school will reopen, not knowing the impact of COVID-19 and, for some, not knowing where their next meal will come from.

“A phrase that personally has been impactful for me is, ‘change is inevitable,’” Lepeau said. “We can’t always anticipate the things that will come our way, but we can control our reaction.”

LePeau and Marquez both suggested creating backup plans and considering multiple options to prepare for the unknown. Students should have a plan A detailing what will happen in an ideal situation and a plan B for what will happen if plan A is unattainable.

Thinking through solutions to potential issues will give students a better idea of their options and how to handle unexpected changes.

Marquez said that it’s important for individuals to consider their learning style when deciding whether to take a gap year or continue school online.

Students who struggled during the second half of the spring 2020 semester may consider taking a break until school is back in person to ensure they’re maximizing their educational experience.

Students who are considering taking a break before starting or continuing their education at the UA should fully understand the university’s admissions and Arizona assurance grant deferment policies, as well as merit scholarship continuation requirements before making any decisions.

“I would encourage students to think through potential solutions to different situations that may arise,” LePeau said. “This can be true at the start of any new chapter in our lives, but even more true during the pandemic that we are currently living through.”

Self-advocate and seek support

For students who play a role in supporting their families financially, having conversations about continuing their education may be more difficult than they have been in the past because of COVID-19, Marquez said.

This is why it’s critical that students both advocate for themselves and seek advice from others on how to overcome their personal obstacles.

For example, if a student who helps to support their family feels a strong need to continue education despite the financial hardships of the pandemic, sometimes those honest conversations are crucial.

If these are difficult conversations for students to have, Marquez suggested talking with someone who shares a similar background as they may have suggestions on how to problem solve in such situations.

Advocating for oneself means understanding one’s wants and needs and effectively communicating those to others. For some students, this may mean candidly weighing the pros and cons of continuing their education and expressing their decision to family members or mentors.

It’s important for students to be direct and self-assured when advocating for their needs.

Whether students decide to take a leave of absence or utilize funds such as scholarships and financial aid, they should have a safe and supportive space to express those wants.

“There are often cultural or generational expectations that need to be respected and sometimes it feels that these conversations around finances are unable to be had,” Marquez said.

Marquez feels it’s important for students to know that when they seek help, they’ll find a supportive community of people who want to see them succeed and are eager to listen.

Follow the Daily Wildcat on Twitter