The University of Arizona provides numerous jobs for students who wish to make money while going to school. Their paychecks help pay for tuition, living expenses and provide disposable income. That is, when students remember to pick up those checks.

Michelle Meyer, senior payroll manager at the UA Financial Services Office, said “I think sometimes students are unsure where to get their checks, some may even be afraid to ask. I have heard from some that they didn’t even realize they had a check.”

According to Meyer, there are 6,499 active student employees on the UA payroll, but that number frequently changes due to new hires and terminations.

“Just like any other employee, the student can opt for direct deposit or can opt to receive a paper check,” Meyer said. “All checks are sent to the student’s primary home department. The department is to make the check available to the student starting on payday.”

Ana Serratos-Gonzalez, a junior studying linguistics, initially used direct deposit, which electronically transfers earned wages directly into a worker’s bank account, when she worked on campus at the Office of Scholarships and Financial Aid. She later had to switch to paper checks after facing troubles with her bank. She is diagnosed with fibromyalgia, which she says made it difficult to walk around campus to pick up paychecks.

“I also had trouble locating where to pick up my check,” Serratos-Gonzalez said. “I asked where it was and was told to go to the wrong office.”

Serratos-Gonzalez recently started using UA’s Disability Cart Service to get around campus but still plans to switch back to direct deposit because she says it’s more convenient.

Students who do not have direct deposit set up must pick up their paychecks from the department they work for, but they have a limited amount of time after payday to do so.

Nancy Greene, the business manager for Arizona Student Media, said “After about a month, we have to send the checks back to FSO.”

Once the checks are sent back after those 30 days, FSO tries to contact students so they can come claim their money, Meyer explained. If students cannot be reached and the check is not picked up within 180 days of the issue date, it then becomes stale-dated, meaning it is no longer able to be deposited. After a check becomes stale, the student must go through a different process to claim it.

“The money is still owed to the employee and since it is paid via a state account, the monies then move into ‘unclaimed funds’ and the student would have to work with the state to get their monies,” Meyer said.

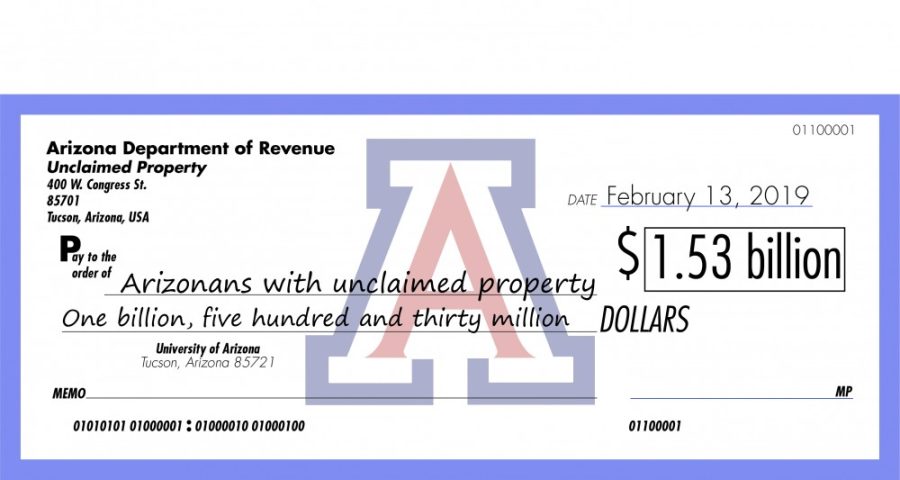

Money from state checks goes to the Arizona Department of Revenue and is kept by the Unclaimed Property program, which seeks to contact the owners of unclaimed property and return it to them. According to the AZ-UCP government website, all reported unclaimed property in Arizona amounts to more than $1.53 billion.

In addition to staled-dated checks, that total includes the values of other unclaimed items including checking accounts, savings accounts, stocks, bonds and safety deposit boxes.

Students’ checks that are reported as unclaimed property can be searched for online through the Department of Revenue. The rightful owner would then fill out a claim form and provide proper identification before the money can be returned to them.

According to AZ-UCP, “ownership of unclaimed property will not revert to the State until 35 years after it was reported, and you may submit a claim at any time during that period.”

Walter Buchanan, the Accounts Payable/Receivable Operations Coordinator at the FSO, hopes students can avoid having to go through the state to get their checks by changing the way they get paid.

“We encourage students to get direct deposit,” Buchanan said. “I think it’ll save everyone a lot of trouble. And I think direct deposit should be mandated in the hiring process.”

In addition to saving time, direct deposit can be more cost-efficient than sending out paper checks. An online transaction could cost just cents, whereas printing, cutting and delivering a check could cost tens of dollars, Buchanan explained.

Buchanan suggests that student workers who do not have direct deposit set up should make sure they know when payday is so they can pick up their checks quickly.

“That check belongs to you,” Buchanan said. “Whether or not you let it go stale is between you and the bank.”

But checks that get lost in the delivery process or get ruined before they are deposited are a different story, Buchanan explained.

“If their check gets lost in mail somewhere or their dog eats it, we can reissue that check within the 180 days,” Buchanan said. “They just have to sign an affidavit saying the check was lost or they never received it.”

Whether you are trying to make ends meet as a college student or you are wanting to go treat yourself on the weekend, setting up direct deposit or picking up your paycheck is an important step in getting your hard-earned money.

Follow Jesse Tellez on Twitter