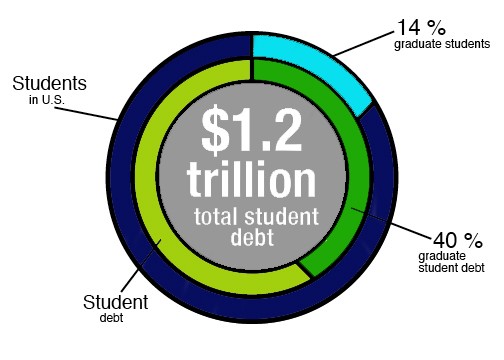

Graduate and professional students account for a significant portion of the $1.2 trillion in federal student debt.

According to a report in Time magazine, graduate students account for about 40 percent of student debt, while generally making up 14 percent of the student population.

Graduate and professional students make up about 22 percent of the student population at the UA with 9,249 students, according to Zach Brooks, president of the Graduate and Professional Student Council.

According to the UA Financial Aid website, the estimated in-state tuition for graduate students is $11,800 and $28,800 for out-of-state students. The cost of attendance, which doesn’t include tuition, is $20,900 for both in-state and out-of-state graduate students..

There are roughly 3,000 graduate assistants at the UA, Brooks said, and their average salary is $16,388 per year. This leaves graduate assistants making about $4,000 less than the average cost of attendance.

Brooks said almost every graduate student starts with a below-cost-of-attendance salary. They then have to pay university fees, deal with a lack of subsidized loans, higher interest rates and in some cases, may be parents having to support their children.

“The impact of paying a higher interest rate, and not being able to get an unsubsidized loan, is becoming very real to millions of Americans,” Brooks said. “People are saying, ‘I’m not going to start a family or buy a house, because I have $500-900 student loan payments a month with a doctorate degree.”

Kristofferson Culmer, director of outreach and 2015 president elect for the National Association of Graduate-Professional Students, said the average amount of student debt for master’s degree students is about $55,000, $75,000 for doctoral students and $146,000 for students studying for a professional degree. The national average for undergraduate student debt is about $29,000. Culmer said there is an inequality between undergraduate and graduate students. This happens, Culmer said, because universities often focus on the largest demographic at their institution, which is almost always undergraduate students.

Congress passed the Budget Control Act in 2011, which put an end to subsidized loans for graduate and professional students. More recently, in 2013, HR 1911 was the first time that legislation stated there would be a difference in the rates that an undergraduate student pays for a student loan and a graduate professional student pays for a student loan.

Culmer said the interest rate on student loans for graduate and professional students is 6.8 percent and only 3.4 percent for undergraduate students.

“When Congress was making legislation in regards to higher education and student loans, the graduate student population was the easiest to take resources away from, [and] over time, it’s just been a steady chipping away of benefits,” Culmers said. “We’re an easy population to do that to.”

There is a general perception that once a student obtains a graduate degree, they make a lot of money, Culmer said, and while that may be true for certain fields, it is not the case for all of them.

“The graduate student debt issue is really big,” Brooks said. “It’s getting worse and has a huge negative impact. Graduate student living is tough.”

_______________

Follow Adriana Espinosa on Twitter.