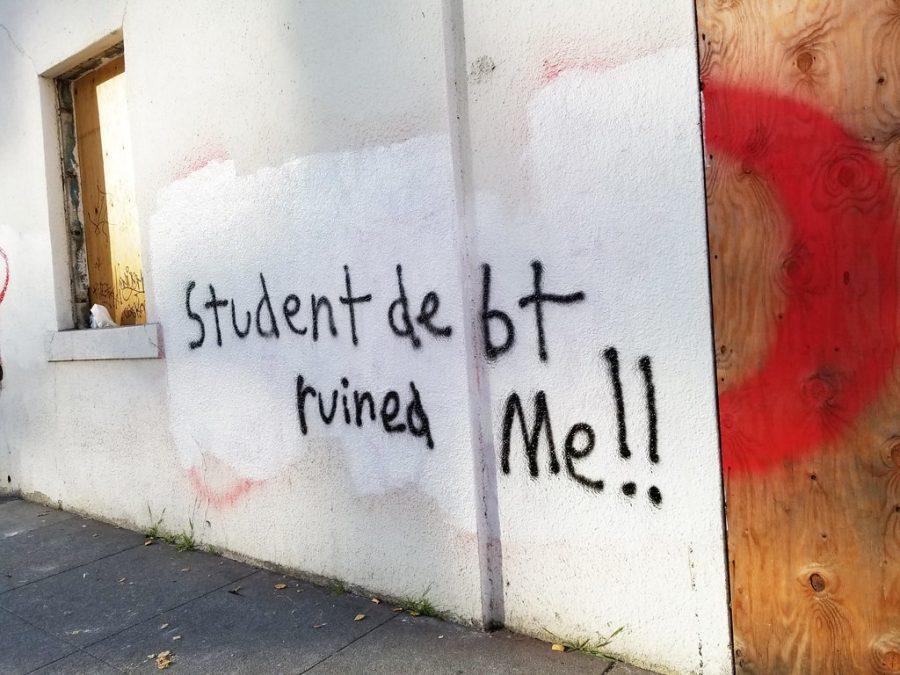

In 2021, the total national student loan debt hit $1.7 trillion. Yes, you read that right.

Student loan debt should officially be considered a crisis. Despite the cost of tuition being sky high, the value of a college degree gets lower and lower with every passing year. Analytics have shown all kinds of crazy insights: undergraduate enrollment is increasing by the millions, tuition costs are positively soaring and, as of 2018, the tuition of a four-year college represented over 20% of the median household income in eight states, according to the Center on Budget and Policy Priorities.

Graduating with loan debt is disheartening, detrimental and sometimes ridiculous. College commencement is a representation of your stepping into the real world and out of that education — replacing sleepless nights studying in the library with sleepless nights poring over a mortgage, or something. You shouldn’t be walking away from your degree program with thousands of dollars of loan debt weighing down on your shoulders as you make your way into real adulthood.

Among the graduating class of 2019, 69% of students took out student loans and finished their education with an average debt totaling $29,900, Student Loan Hero and LendingTree reported. That is an insane amount of debt for just one year’s worth of graduates. Pile on all of the graduates from years before who are still unable to pay off their loans because of combinations of high interest rates and lower wages, and then, add in all of the future graduates who will have to take out loans, and the math starts to make sense. No wonder student debt has reached the trillions.

RELATED: COMIC: Birdseed’s sixth episode

Students are currently drowning in student debt, and it’s not looking like it’s going to get any better anytime soon. It’s even causing problems other than economically. According to NPR, research done by the Federal Reserve has shown that student loan debt has caused this generation of graduates to own homes, get married and start families significantly later than earlier generations. Some of this can be accounted to more of a general sentiment of enjoying the youthfulness of being in your twenties, but a lot of the delay can be credited to debt-making settling down impossible. It’s even been proven by researchers Robert Bozick and Angela Estacion that for every $1,000 in student debt a woman has, the odds of her marrying within the first four years after graduating college decrease by 2%.

Society as a whole puts a huge emphasis on getting a college degree. There are 57% more job opportunities for college graduates than high school graduates, according to the Georgetown University Center on Education and the Workforce. If degrees are so important to attaining a career, then why is the price of higher education so unrealistic? The tail-chasing experience of having to take out loans to get a degree to get a job that pays enough that you can pay off those loans is both excruciating and way too common for students.

Hopefully, the future will bring change to the education system that will give students a chance to earn their degree without shoveling themselves deeper and deeper into a pit of debt they can never hope to pay off. College is important and valuable to students who learn and grow both physically and mentally on campus, but no one should have to spend the next 10 to 30 years shouldering through debt for four years’ worth of education.

Long story short, graduation is bittersweet for a lot of reasons. Leaving behind your friends and the place where you’ve learned and grown for four years is hard. Moving on into the next chapter of your life is exciting and every 2021 graduate should be so proud of how well they’ve done despite the cards they’ve been dealt this past year. Though I have still have a year until my own graduation, I look forward to looking back at all the memories we made and all the fun we had in college — I just wish we could do that without also remembering the trillions of dollars we collectively owe.

Follow Mandy Betz on Twitter

Mandy (she/her) is a junior studying journalism and public relations. She spends her free time shopping, writing and hanging with friends.