The UA is considered among the country’s wealthiest universities – in terms of endowments, at least.

The university received $532 million in endowments – financial gifts from private donors – in 2007. That figure ranked 136 out of a listed 785 institutions in reports from The National Association of College and University Business Officers.

In 2006, the UA received $466 million in endowments and was ranked 133 out of 765, according to the reports.

With the average endowment total for the listed universities at $91 million for 2007, the UA resides in the top 20 percent.

“”The numbers of private donations to the UA have gone up quite a bit in the last couple years,”” said Johnny Cruz, the university’s director of media relations.

Endowments are important for universities because they “”provide a lifetime income stream,”” said John Brown, director of communications and marketing for the UA Foundation, a private company that manages the university’s endowments and gifts.

Endowments, once given, go to support anything the donors wish.

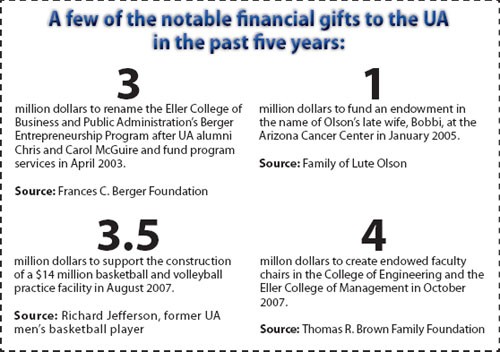

Last month, UA alumna Stevie Eller funded an endowed faculty chair in the School of Dance, largely to keep program head Jory Hancock at the university.

In January, alumni J. David and Edith Lowell donated $4.5 million to support construction of a new basketball and volleyball practice facility and a new program in mining and geological engineering.

The UA Foundation manages more than 1,200 endowments, which constitute a $310 million portfolio and an asset base of about $450 million, Brown said.

All that money is pulled together and invested through a committee that helps the UA Foundation manage the portfolio, he said.

Donors may structure their gifts differently, but the basic endowment works as follows: If, for example, someone donates $1 million, the university puts it in the bank and the interest accrued is what the university spends, Brown said.

The UA’s minimal return target, or interest made off an endowment, is 8.75 percent. That figure includes a cost-recovery fee of 1.25 percent, a 3.5 percent fee meant to keep the endowment’s value ahead of inflation and a 4 percent payout rate.

The money from the payout rate goes to the area the endower wishes to aid, Brown said, adding that the UA’s rate is slightly below the national average of 4.5 percent.

Donors can specify different situations in terms of interest rates and how the endowment is designated, he said.

“”Some endowments you can spend the principal, but generally we wait about a year before we actually begin to send payout to the program it’s designated for,”” he said.

According to the UA’s 2007 Endowment Report, 23 percent of the university’s annual operating budget of about $900 million comes from the state of Arizona, with the rest coming from other sources.

In the report, UA President Robert Shelton states, “”No form of investment is more important to a university’s long-term success than its endowment.””

Shelton has said fundraising is one of his largest priorities as president. In particular, he seeks to raise money for endowed chairs and scholarships.

“”All universities must rely on the generosity of their supporters to provide (a) margin of excellence,”” he wrote in an e-mail. “”We are fortunate to have state support for the core salaries of our faculty, but to attract and retain the very best, we need additional resources.””

The UA’s endowment totals fluctuate each year, as they do at every university, Brown said.

“”When we have a strong year, we can allocate money to other initiatives on campus, but we also have to prepare for slower economic times,”” Brown said. “”We have seen since the start of this year that a lot of our management accounts are well below where they were a year ago.””

The flow of endowments forces the UA Foundation to adjust its payout rate depending on a variety of factors, Brown said.

Such criteria include the net rate of return in each of the five most recent fiscal years, higher education price index, state appropriations and university needs and how other universities are managing their endowments.

“”We just want to be on par with what our peer institutions are doing,”” he said. “”It gives us a good indication that we are meeting or exceeding what is termed best practice for universities, in terms of managing our assets.””

A Dec. 21 New York Times editorial stressed the fact that donations to overly wealthy schools are allowing them to live off interest, while other institutions are working hard to make it through the next day.

Most endowment funds are concentrated in a small number of public and private universities, with the wealthiest 10 percent holding most of the assets, according to the College Board.

The organization’s figures show that the top 10 percent of private institutions have ten times the amount of funding as public institutions.

The UA cannot live off its endowments as can schools such as Harvard, Yale, Stanford and Princeton, which receive gifts totaling in the billions of dollars, Brown said.

“”Endowments like theirs can grow more in one year than all we have put together,”” he said. “”The income our endowments generate really counts for less than 1 percent of the operating budget of the university.””

Because endowments seem to constitute a growing resource, national lawmakers are questioning the reasons behind the rapid tuition increases plaguing colleges nationwide.

On Jan. 31, the U.S. House of Representatives passed an amendment that requires colleges to report on how much of their endowment they are spending to keep tuition costs down.

An earlier amendment, proposed and withdrawn by Rep. Peter Welch, would have required colleges to spend at least 5 percent of their endowment assets per year.

“”Nothing has gone to the Senate yet so nothing has changed for us. We’ll obviously comply with any changes that the government makes,”” Brown said. “”President Shelton did go to (Washington) D.C. in February to discuss the matter, and I think a lot of universities’ presidents are involved in giving lawmakers information on what we need and how we operate.””